AS REPORTED BY THE US DEPARTMENT OF AGRICULTURE

WHOLESALE CHEESE MARKETS

NATIONAL - DEC. 17: Cheese plant managers report milk is still snug, but influxes are expected to increase over the upcoming holiday weeks, as Class I and some Class III plants take some time off. Spot milk prices in the Midwest ranged from Class III up to $.50 over Class. Cheese production is generally busy. Staffing shortages remain a common theme among contact notes, but most plant managers are making due with lighter crews. Cheese demand is falling in two columns: steady and busy. Cheese inventories are adequate.

NORTHEAST - DEC. 22: Steady milk supplies are clearing to Class III. Production is active for Cheddar, Provolone, and Mozzarella, but some Northeastern cheese makers will pause operations over the holiday. Cheese inventories are ample. Retail sales remain strong. Many grocery chains are offering cheese promotions in weekly ads. Foodservice demand is a little softer. Educational institutions are closing for winter breaks, and eatery traffic is said to be down as would-be diners face Omicron uncertainties and strengthening restrictionss. Reports indicate that some restauranteurs are limiting services or temporarily closing locations amid the challenges of staffing shortages and rising COVID case counts.

MIDWEST AREA - DEC. 22: Midwestern

cheese makers reported spot milk prices at expected discounts, below

$1-under Class III, but compared to the holiday week last year, milk is

notably less available; prices were as low as $8.50 under on Dece. 23,

2020. Demand for cheese has been very steady in recent weeks/months.

Some curd producers reported taking advantage of a slower ordering week

to work on plant maintenance. Employee numbers are fair, although some

plant managers continue to report that they are not comfortable with

current shifts, and a lot of attending employees are working long days.

Cheese availability is balanced to tight in the region. Cheese price

movements are somewhat steady this week, but the large gap remains.

Market participants say the $.20+ price gap between blocks and barrels

on the CME leaves near term bullishness in doubt.

WEST - DEC. 22: Demand

for cheese is mixed; retail sales are steady while foodservice demand

is declining. Contacts report that foodservice sales have softened as

schools are closing for winter break. International demand for cheese is

strong, with contacts noting steady purchases of cheese for export to

Asian markets. Deliveries continue to face delays due to port congestion

and a shortage of truck drivers. Spot purchasers report no change in

availability for either cheese barrels or blocks. Some market

participants are, reportedly, accepting lower prices to move loads

before the end of the year. Cheese makers say that milk is available for

production in the region, though some are running decreased schedules.

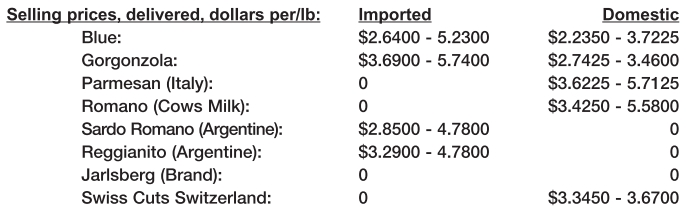

FOREIGN -TYPE CHEESE - DEC. 22: The

Western European cheese situation is described as an insufficient

supply, lower than demand. Orders have experienced cuts in shipments.

Manufacturers are sometimes forced to make tough decisions allocating

available stocks, even sometimes shorting long-term customers. Retail

customers as well as foodservice destinations are jockeying for

restocking priority. With constrained cheese production reflecting tight

milk supplies, as well as low existing stocks, this situation is

expected to continue for a while. Projections for 2022 are for slightly

more cheese production.