The relationship between elections and the stock market

When people think about cycles in the stock market, they tend to look at the obvious drivers of stock prices:

major forces such as the state of the economy, the level

of corporate profits and conditions in global markets. But did you know

that a presidential election itself can be a key pivot point in stock

price trends?

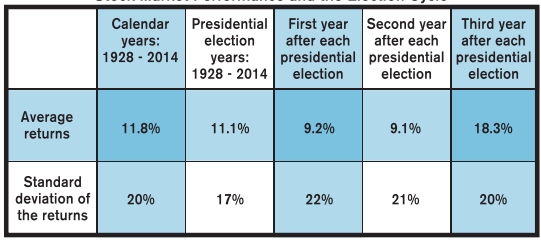

Consider the average yearly performance of the stock market in the table below.

After accounting for random volatility, average presidential election

year performance was slightly below overall average performance.

But

look at the other years in the election cycle. The first two years of

presidential terms have, on average, lagged significantly. But then, in

the third year, the market made up the lost ground and more.

What’s Going On?

Election

years tend to have a degree of uncertainty over the future direction of

the country, and the market may translate that uncertainly into some

reluctance to commit on the part of investors. Then, after the direction

is set, it may take some time for policy changes to assert any

influence, further depressing investment demand. By the third year, clarity could return and investors could embrace the future.

Exceptions May Be More Powerful Than the Generalities

Keep

in mind that the amount of variation in annual returns is substantial,

and is reflected in the high variability, measured by standard

deviation. As a consequence, the chances are good that performance in

any given year could end up being far different from the average for its

category.

That

becomes clear when looking at the extremely good and extremely bad

performing years in the S&P 500 performance data set. The four best

years were 1928 (44%), 1933 (53%), 1935 (60%), and 1954 (52%). The four

worst years were 1931 (-41%), 1937 (-34%), 1974 (-26%), and 2008 (-37%).

No two of the

extreme up years occurred at the same point in an election cycle,

neither did any two of the extreme down years. Three of the extreme

years are associated with Democratic incumbents and five with Republican

incumbents.

Ultimately,

six of the eight extreme performance years were associated with

unpredictable macroeconomic tidal waves – the Great Depression, the oil

price shock (when energy prices quadrupled in a few months), and the

recent financial crisis – events much bigger than any election news.

So

if you are thinking of cashing in on an election year rally – or

selling before an election year rout – think again. As history has

shown, trying to time the market–for whatever reason – is often a

loser’s game. Instead, work with your financial advisor to determine an

appropriate long-term asset allocation that suits your goals and needs.

– Denis Poljak

If you’d

like to learn more, please contact King Poljak Group at Morgan Stanley.

Article provided courtesy of a Morgan Stanley Financial Advisor. The

author(s) are not employees of Morgan Stanley Smith Barney LLC ("Morgan

Stanley"). The opinions expressed by the authors are solely their own

and do not necessarily refl ect those of Morgan Stanley. The information

and data in the article or publication has been obtained from sources

outside of Morgan Stanley and Morgan Stanley makes no representations or

guarantees as to the accuracy or completeness of information or data

from sources outside of Morgan Stanley. Neither the information provided

nor any opinion expressed constitutes a solicitation by Morgan Stanley

with respect to the purchase or sale of any security, investment,

strategy or product that may be mentioned. Morgan Stanley Financial

Advisor(s) engaged The Forum to feature this article. King Poljak Group

may only transact business in states where they are registered or

excluded or exempted from registration MorganStanleyFA.com/Poljak.

Transacting business, follow-up and individualized responses involving

either effecting or attempting to effect transactions in securities, or

the rendering of personalized investment advice for compensation, will

not be made to persons in states where King Poljak Group is not

registered or excluded or exempt from registration. © 2016 Morgan

Stanley Smith Barney LLC. Member SIPC. CRC 1362931 [12/15]