We welcome letters. Please include your full name, address and telephone number. We edit all letters. Send them to [email protected].

We welcome letters. Please include your full name, address and telephone number. We edit all letters. Send them to [email protected].

GROWING UP IN JACKSONVILLE

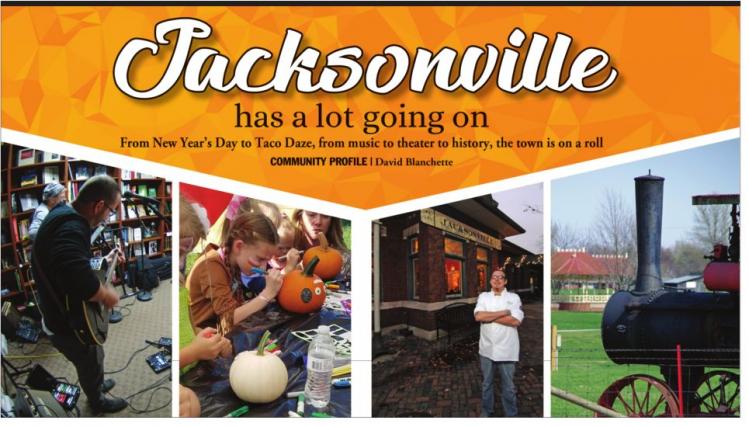

Thanks to David Blanchette for an excellent article on Jacksonville (“Jacksonville has a lot going on”) in the Dec. 7 edition of Illinois Times.

I was privileged to be raised in Jacksonville from kindergarten through high school and Illinois College. It was simply a great place to grow up in the 1930s and ’40s.

We three Mills boys could grab our swimming suits, jump on our bikes, and be at Nichols Park swimming pool in 20 minutes. No one locked their homes, everyone left their car keys on the car floor, and everyone knew whose husband was good and whose check was bad.

The tree-lined streets of my childhood and formative years will always be constant on my mind. Thanks, Dave, for the walk down memory lane. Richard Mills United States District Judge

EDUCATIONAL ASSISTANCE PROGRAMS

I finished reading Scott Faingold’s article titled “Persistent resistance” published in the Dec. 7 edition of Illinois Times. While there is much to criticize in this article pertaining to the resistance whiners, I will

limit my comments to the remarks attributed to Dr. Amy McEuen, associate

professor of biology at University of Illinois Springfield.

It appears that Dr.

McEuen

is as skilled in the art of hyperbole and misrepresentation as she is

in the science of biology. She claims that a new provision of the

proposed tax bill will punish the poor and people of color, enrich the

already wealthy, increase the student debt crisis, and adversely affect

important research programs. Saul Alinsky would be proud. However,

before readers start to cry in their petri dishes over this evil House

(not Senate) Republican tax plan, let’s just look at what the facts tell

us.

Under current tax

law, there at two types of educational assistance programs excludable

from gross income: Code Sec. 117 (a) “qualified scholarships” and Code

Sec 117 (d) “qualified tuition reduction.” The important distinction is

that Code Sec. 117 (a) scholarships are made without the requirement

that the student work as a teaching or research assistant. Code Sec 117

(d)(5) assistance applies to graduate teaching or research performed as a

condition of receiving the waiver. Under the proposed tax bill, if you

work for the financial assistance you receive under a Code Sec 117 (d)

waiver, that assistance would not be excludable from gross income.

Is

this the end of western civilization? Hardly. Universities can simply

change the terms and conditions of how such assistance is awarded and it

can still be excluded from gross income under Code Sec 117 (a).

Obviously, the university could no longer require the recipient to work

as a condition of receiving the aid, but this is not really an issue,

because as Dr. McEuen acknowledges, most recipients are already working

and receiving a taxable stipend from the university in exchange for

their services. That work would continue unchanged.

I

know it makes a bold statement to hold a protest and to be a part of

the loyal resistance. But honestly, all you need to do is just

restructure the current way tuition waivers are awarded and count your

blessings that those mean old Republicans left you with the Code Sec.

117 (a) “loophole,” so use it. Students must learn to adapt to changes

in tax law just like everyone else. If the changes are eventually

adopted, I am confident that the University of Illinois has sufficient

intellectual capacity to implement a solution, and will not leave this

issue to be resolved by the martyrs in the biology department. Gary Hetherington Springfi eld