THR heads for bankruptcy

BUSINESS | Bruce Rushton

Not so long ago, Jeffrey Parsons was on top of the world.

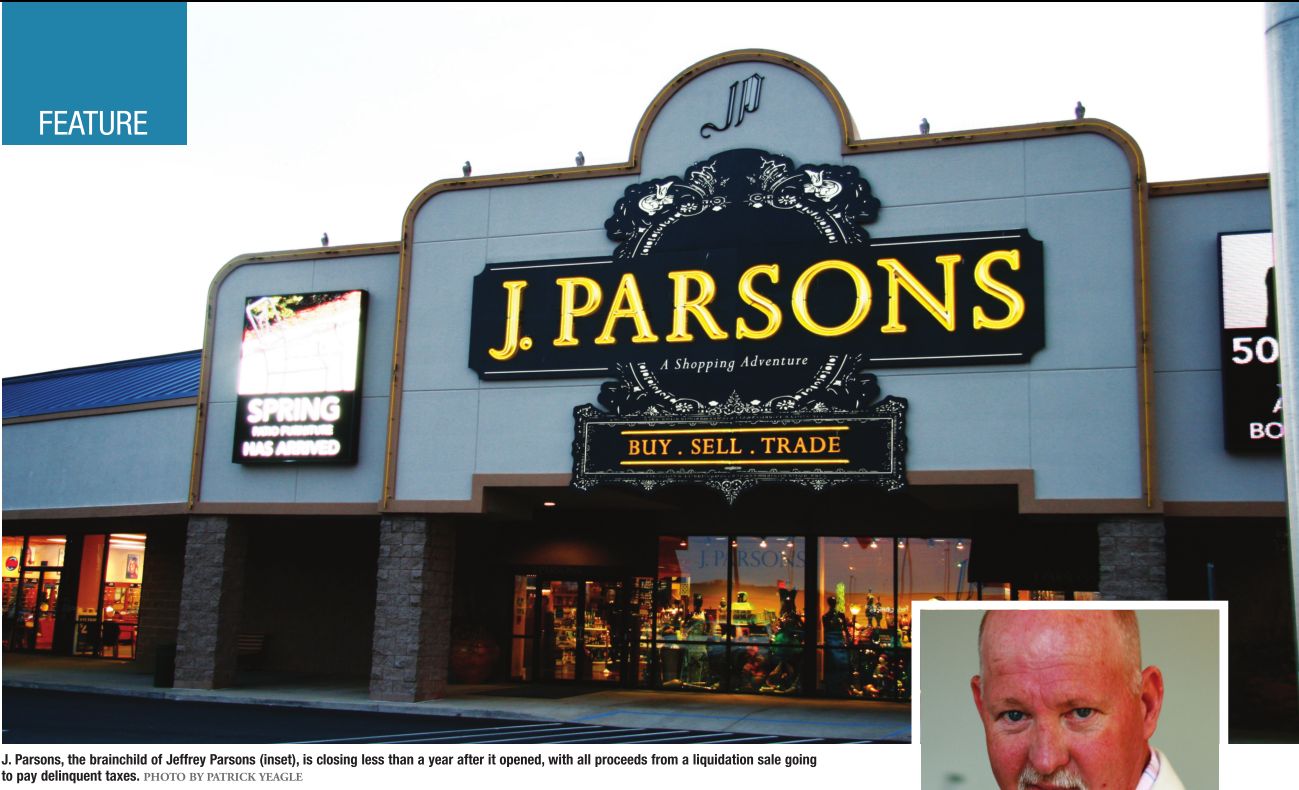

J. Parsons, the west side store that sells everything from socks to shoes to hats to watches to pants to historic documents to gourmet cheese, opened the day after Thanksgiving. Parsons was fast becoming a household name in Springfield, thanks to television commercials for the store that were in heavy rotation during the Christmas shopping season, each one featuring himself looking dapper in expensive suits.

Help wanted billboards erected in Springfield promised six-figure salaries to folks who went to work for THR & Associates, a company formed in 2008 that almost overnight became a multimillion-dollar firm. With Parsons as its president, CEO and sole shareholder, THR set up buying events in hotels throughout the nation, luring customers through newspaper ads, then convincing them to sell coins, jewelry, watches, antiques and anything else of value, especially if it contained gold or silver.

The goal was to buy low, sell high, and THR did a lot of it. In 2010, the company had revenue of $125 million and Parsons reaped nearly $9 million in profits. Revenue last year was $211 million, with a net profit of almost $11 million, according to testimony in the pending divorce case of Parsons vs. Parsons, which has laid bare the inner workings of THR and the largesse of Jeffrey Parsons, who had finally hit it big. But not for long.

THR is headed for bankruptcy, and its bank accounts have been frozen by the Internal Revenue Service, according to recent testimony in the divorce case. The Illinois attorney general’s office has launched an investigation, and a federal criminal probe could be in the offing.

Between delinquent payroll taxes and unpaid personal income taxes, the state and federal governments are owed about $13 million by THR and Parsons, who resigned as the company’s chief executive officer on July 13, a Friday. He deposited his final paycheck in the account of his live-in girlfriend and mother of his infant child so that the IRS would not seize the money. He testified last week that his own bank account has a balance of $360.

Four secondhand stores remain in business in Springfield, Jacksonville and Urbana, but Parsons testified that the stores, called Buy Sell Trade, are putting proceeds into safes instead of bank accounts. Paying taxes has never been a priority for Parsons, who didn’t file tax returns between 2002 and 2008, according to court testimony, and has racked up a series of IRS liens dating back to 1996.

THR’s main bank account at Chase Bank is overdrawn by $6,000 and virtually all employees have either resigned or been laid off, Sally Runyon, company bookkeeper, testified last week. In addition to freezing THR’s bank accounts, the IRS has levied accounts at The Gold Center in Springfield and Heritage Auctions in Texas, where THR has sent coins and scrap metal to be either melted or sold to collectors. The pipelines of cash have been huge, with Heritage sending at least $14 million to THR this year and The Gold Center sending $43 million between January and May.

It is all gone, according to Parsons, who last week testified that he signed over a $10,000 cashier’s check, remnants of a THR account at PNC Bank, to a bankruptcy attorney on July 18, with a Chapter 11 filing expected. The company is facing 29 lawsuits, many from creditors, and landlords are evicting TRS from its offices, Runyon said. An unknown number of employees have not been paid wages due.

“They owe me about $2,500,” says Warren Myers, a former Springfield resident who worked as a buyer at THR shows and now lives in Nebraska. “I’ve actually tried to talk to the attorney general, trying to put pressure on them. Someone has to put pressure on the attorney general to press charges.”

Natalie Bauer, spokeswoman for Illinois attorney general Lisa Madigan, says the attorney general has received nearly 100 complaints from consumers about THR, mostly about bounced checks, and has been in contact with other agencies, including federal law enforcement entities.

“We’ve launched a full-scale investigation on the civil side,” Bauer said. “Many, many consumers have called our office. ... This is a very serious situation – we recognize that. We’re doing whatever we can to investigate and get this to the attention of the appropriate authorities.”

Lives of luxury

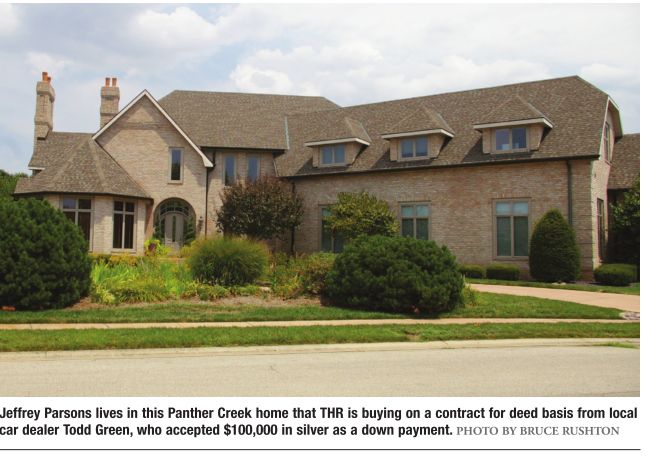

While employees, vendors and the IRS go unpaid, Parsons and his estranged wife live in luxury, she in a mansion near Athens, he in a Panther Creek home worth more than $1 million.

Parsons in January testified that $2.8 million has been invested in the Athens home, but still it had issues that Buraski Builders, a Springfield company, estimated would cost nearly $300,000 to fix. The tab to repair a doggie door was $500, repairs to a

garage that was home to a feral raccoon would cost $40,000 and fixing a

two-story indoor fountain that had damaged the home’s interior due to

materials that weren’t waterproof would total $2,000, according to a

February report from Buraski.

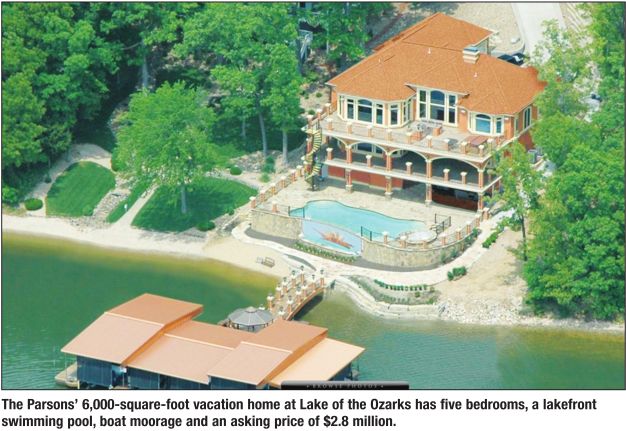

The couple also owns vacation property at Lake of the Ozarks in Missouri where four boats, including one dubbed Dirty Money, are

moored. Parsons last week testified that the boats have a combined

worth of more than $100,000. The property is now listed for sale with an

asking price of $2.8 million. Home furnishings at residences in

Illinois and Missouri are worth hundreds of thousands of dollars,

Parsons testified, and include a Chinese wedding bed once owned by

Johnny Cash and his wife, June.

The couple also owns vacation property at Lake of the Ozarks in Missouri where four boats, including one dubbed Dirty Money, are

moored. Parsons last week testified that the boats have a combined

worth of more than $100,000. The property is now listed for sale with an

asking price of $2.8 million. Home furnishings at residences in

Illinois and Missouri are worth hundreds of thousands of dollars,

Parsons testified, and include a Chinese wedding bed once owned by

Johnny Cash and his wife, June.

The

bed pales in comparison with the halfshare of a Cessna jet that THR

purchased last fall for $600,000 in silver coins. Parsons testified that

he has taken the jet to Florida, New York and Las Vegas, although he

said those trips were for business. The company also owns a Piper

Cherokee airplane. Cars include a Bentley bought last year for $80,000

and a 2009 Cadillac Escalade hybrid driven by Parsons, who used silver

coins to buy the hybrid from local car dealer Todd Green, who also

accepted silver for the Cessna.

Jennifer

Parsons, who filed for divorce last year, owns a Rolls Royce and a

Mercedes. She survives on $25,000 a month given to her by her estranged

husband.

Jennifer

Parsons last week testified that she spends $2,500 a month on swimming

pool and lawn maintenance, $1,250 a month on clothes and $2,000 a month

on food for herself and a daughter.

“Where do you buy your food?” asked Gregory Scott, attorney for Jeffrey Parsons.

“Different places,” Jennifer Parsons answered. “Sam’s Club, County Market.”

Jeffrey

Parsons, who vowed to limit personal spending to $25,000 in a January

agreement with his estranged wife, has also been shop ping.

A March tab at two Florida fishing tackle stores totaled more than $23,000, according to THR financial records.

Panther

Creek Country Club bills incurred by Jeffrey Parsons include a March

tab for $4,328 and an April bill for $5,919. Parsons last week testified

that he is cutting back. Since THR has tanked, Parsons said he will no

longer have business associates to fete in the clubhouse and so will

limit himself to using the golf course.

While

the company is behind on rent for its headquarters and other

properties, it was current as of June 15 on payments to Green for the

Panther Creek house where Jeffrey Parsons lives. Since closing a deal

for the home late last year, THR has paid Green at least $55,000 in

monthly installments and spent an additional $88,000 on improvements,

according to court testimony. Parsons moved in after paying Green an

upfront fee of $100,000 in silver coins. Last spring, Parsons used

silver to buy a boat from Green, who testified the coins were worth

$150,000.

Not

surprisingly, the IRS has taken an interest in divorce proceedings where

THR’s finances are discussed. Besides purchasing transcripts of court

hearings, the IRS has been in touch with Jennifer Parsons’ legal team.

“The

IRS…has a team of people working on this, and has countless resources,

has not closed the book on this,” said Peggy Ryan, Jennifer Parsons’

lawyer, during a February hearing. “We are constantly getting calls from

them. We are constantly aware of subpoenas and so on and so forth. They

have not been able to put things together.”

With tax collectors closing in, Jennifer Parsons sent a text message to her estranged husband in May, offering a way out.

“If you sign things over to me, I’ll share them with you so the IRS can’t take it,” Jennifer Parsons wrote in the message.

Jennifer

Parsons testified that she sent the message because she wanted a

settlement in the divorce case – the court file is 16 inches high and

growing. Much as he might dislike paying taxes, Jeffrey Parsons

apparently hates paying his estranged wife even more.

“He told me he’d rather they (the IRS) have it,” Jennifer Parsons testified.

A series of ventures

THR is just one in a series of businesses launched by Jeffrey Parsons, the consummate Energizer Bunny of entrepreneurs.

During

the mid-1990s, Parsons sold fruits and vegetables out of tents, with

one in Lincoln and two in Springfield, where a city health inspector

found that he was selling foodstuffs without a proper license. Then

Mayor Karen Hasara intervened, refusing to shut down tents set up

outside White Oaks Mall and at JC Penney, despite health department

concerns. After a health inspector informed White Oaks Mall that Parsons

didn’t have a proper license, Hasara suspended the inspector for five

days.

The inspector,

who went on to become an FBI agent, sued the city for violating her

free-speech rights and collected a $41,000 settlement. It’s not clear

what happened at White Oaks Mall, but the 15,000-squarefoot tent on

Dirksen Parkway blew away during a 1998 windstorm and ended up draped

over a utility pole.

As

a businessman, Parsons has long lived on the brink, time and again

racking up liens for unpaid state and federal taxes. In 1997, he filed

for Chapter 13 bankruptcy and said he was doing business under a

half-dozen names, including American Passport Publishing, Amish Valley

Farms, Big Lake Properties, Parsons Produce, Illinois Safe and Sane

Fireworks and Totally Nuts.

After

making more than $118,500 in monthly payments to a trustee, Parsons was

discharged from bankruptcy in 2002. But a flow of state and federal tax

liens dating back to at least 1996 never went away. Liens started

fairly small, with a $3,098 levy by the by the state Department of

Revenue in 1996. The IRS followed a month later with a $25,000 lien for

unpaid payroll taxes and a few months later filed a $29,544 lien for

unpaid 1994 income taxes.

Parsons

paid the 1996 liens, but he has never stayed current with taxes for

long. In 1997, the IRS levied liens totaling nearly $39,500 that weren’t

paid for five years. Liens of six and seven figures began in 2010,

after THR began churning millions of dollars in profits. Parsons has

testified that instead of paying his taxes he put the money into THR to

expand the business.

By

2003, Parsons had moved from vegetables to firearms, becoming director

of the International Gun Safety Council, which offered to purchase guns

for $25 apiece at events dubbed gun buybacks that were typically held at

hotels. Parsons told the media that the council was performing a public

service by purchasing guns for resale.

“We’re

an outlet for these folks to legally, responsibly get rid of their

unwanted firearms, so law enforcement should be tickled to death,”

Parsons told the Beacon News of Aurora in 2003.

Police were less than amused. “What they are doing is not illegal,” Dan Ferrelli, Aurora police spokesman, told the Chicago Sun-Times. “However,

the words ‘gun buyback’ imply this program has law enforcement

associations, which is not the case. We feel their advertising for the

event is misleading.”

The

federal Bureau of Alcohol, Tobacco and Firearms asked the International

Gun Safety Council to remove the agency’s name and phone number from

fliers promoting buying events, saying it neither endorsed nor had any

involvement with the organization. Gun control advocates were also

concerned.

“Sounds

like Jeffrey is trying to make a quick buck and masking it as a public

service,” Thomas Mannard, executive director of the Illinois Council

Against Handgun Violence, told the Sun-Times.

At

the time, Parsons was also selling fireworks and running afoul of the

state fire marshal, who alleged that Four Seasons International, the

fireworks company, was selling illegal wares. In 2003, Parsons signed an

agreement with the state in which he promised not to sell illegal

fireworks, but he was soon back in Menard County Circuit Court, where

the state presented the judge with affidavits from several fire chiefs

who said that Parsons had broken the agreement.

“If

I were you, I would be very careful not to be selling anything that was

agreed to in that order, and the order was a very specific order,”

warned Menard County circuit judge Carol Pope, who told Parsons that he

faced jail and fines if he continued selling fireworks deemed illegal

and the state pressed the matter.

In

2004, Parsons set up un-manned vending machine stations under the

business name Get And Go Express on vacant lots in Springfield, taking

advantage of a loophole in zoning regulations that aldermen soon closed

by requiring landscaping, parking spaces and other amenities. Dubbed

“Home of the 25cent Soda,” Get And Go would eventually offer pizza

cooked in under two minutes along with soft drinks, candy and other

snacks, Parsons predicted, and franchises would sprout nationwide.

The

crumble began in the fall of 2005, when Four Seasons declared

bankruptcy. According to court documents, Parsons had intermingled funds

between Four Seasons, Get And Go and other businesses to the point that

they were all the same enterprise for purposes of the bankruptcy

proceeding.

Making

matters worse, the attorney general in 2005 sued Parsons for alleged

violations of consumer protection and deceptive business practices

statutes, saying that he had promised good wages to people who responded

to newspaper ads to staff fireworks stands, then never paid them. The

lawsuit is still pending in Sangamon County Circuit Court.

When the dust settled, more than $306,000 in bankruptcy claims went unpaid. Springfield’s last remaining Get And Go on Dirksen Parkway is covered in dust

and hasn’t quenched thirsts in years. Two Sangamon County lawsuits filed

against the Home of the 25-cent Soda for nonpayment of debt remain

open.

A new beginning

On

Aug. 12, 2008, Jeffrey Parsons, by then a defendant in more than 20

Sangamon County lawsuits alleging nonpayment of debt, started fresh by

filing incorporation papers for THR & Associates with the Illinois

Secretary of State.

The

schtick – traveling the nation buying valuables for resale – remained

the same, but Parsons operated under no fewer than 17 names, ranging

from the Ohio Valley Gold and Silver Refinery to Mississippi Valley Gold

and Silver Refinery to Cash For Tools to the International Vintage

Guitar Collectors Association to International Gold and Diamond Buyers

Association to Treasure Hunters Roadshow.

Awash

in cash, Parsons became a darling of civic leaders, including Greater

Springfield Chamber of Commerce officials and former Mayor Tim Davlin.

Davlin

and chamber representatives attended when Parsons held a 2010 press

conference to mark the opening of THR University in a Wabash Avenue

office building, where he said he would train people to appraise and buy

valuables. He used stretch limousines to whisk reporters between the

new facility, company headquarters on Pleasant Run and a processing

center on Springfield’s west side through which millions of dollars

worth of precious metals flowed.

Civic leaders proclaimed themselves delighted.

“The hiring plan they’re looking at right now is phenomenal,” Davlin gushed in a 2010 story published by the State Journal-Register. “These are good-paying jobs, too.”

However,

no paychecks would be issued until prospective employees completed five

weeks of unpaid training, a full-time endeavor. That didn’t bother the

chamber.

“I don’t

think it’s problematic, especially because of the wages they say they’re

paying,” Erich Bloxdorf, executive vice president of the chamber, told

the SJ-R in 2010. “It looks like they’ve had pretty strong growth

over the last three or four years. … The headquarters is here, so the

wealth comes back to Sangamon County, so that’s a good thing.”

But cracks were appearing even as Bloxdorf and Davlin gave thumbs up.

Checks

written to customers who sold items to THR bounced in 2008 and 2009;

the company blamed an accounting snafu. In 2010, WGBH, the Boston

public-television station that produces “Antiques Roadshow,” sued for

trademark infringement, saying that consumers were getting pennies on

the dollar for valuables and were confused by THR’s use of the name

Treasure Hunters Roadshow as well as a logo that was similar to a

treasure chest logo used by “Antiques Roadshow.”

“Defendants

capitalize on the Roadshow name in order to try to purchase products on

the cheap for purposes of resale,” WGBH said in its lawsuit, which was

settled for more than $300,000 and a promise from Parsons to start using

disclaimers and stop using the treasurechest logo.

It

was the second time that WGBH had sued Parsons, who years earlier had

agreed to pay the station $21,500 after getting hit with a trademark

infringement lawsuit for using the term “Antique Toy Roadshow” when set

ting up shows to purchase old toys.

Parsons

is now facing more than two dozen lawsuits, but Don Craven, a

Springfield attorney for WGBH who last month sued Parsons on behalf of a

local software company that is owed more than $100,000, doesn’t like

the odds of plaintiffs recovering anything.

“I

think it’s going to be very difficult to trace any hard assets to

collect any judgment that might be awarded by the court,” Craven said.

End game

Jeffrey

Parsons declined comment after a July 18 hearing in his divorce case,

but in a voicemail message sent later, he said that all assets purchased

with THR monies belong to the company, not him. He also predicted that

employees who haven’t been paid will ultimately receive their wages.

“It’s

my belief that THR and Associates’ assets far outweigh any debt,

including those employees,” Parsons said. “We decided to declare

bankruptcy, and they’ve tied my hands as far as spending any money.”

Jeffrey Parsons has otherwise had no comment after recent court sessions in his pend ing divorce. It’s not hard to imagine why.

When

asked about Rolex watches he once plucked from THR’s inventory to wear,

Parsons last month testified that he doesn’t do that anymore.

“Melted and gone,” Parsons answered when his estranged wife’s lawyer asked about the timepieces.

Time

and again, Sangamon County associate judge Steven Nardulli has issued

verbal spankings, threatening Parsons with receivership and wondering

aloud whether assets are being hidden.

“Real

estate can’t disappear like gold and silver can disappear,” Nardulli

said during a June hearing when the fate of the Ozarks property was

discussed. “That’s a big part of my concern about all of this.”

After

a private investigator hired by Jennifer Parsons last week testified

that he had recently seen vehicles coming and going from the Wabash

Avenue processing center where THR’s treasure has been stored, Nardulli

ordered the parties to lock the building up immediately and keep

separate keys pending an inventory.

“Two sets of padlocks,” the judge said. What happens next is anyone’s guess. J.

Parsons

is going out of business, with all proceeds of the liquidation sale due

to go to the IRS. Proceeds from the sale of THR’s vehicle fleet are

also supposed to go to the IRS, but the first check written to the IRS

from vehicle sales didn’t clear the bank, Runyon testified last week.

A lot of little people have been hurt along the way, Craven says. Some employees quit good jobs to go to work for THR, he says.

“You

have bags of silver used to buy planes and boats and automobiles,”

Craven said. “We have no explanation as to why there aren’t little bags

of silver to pay the employees.”

Tiffany

Poe of Springfield, a THR employee who was laid off last spring, says

that she can’t understand why Parsons hasn’t been charged with a crime.

“He’s bouncing checks to employees,” Poe says. “Somebody’s protecting him. Anybody else would be in jail.”

Contact Bruce Rushton at [email protected].