Nine ways the rich get richer. But you don’t.

continued from page 13

Data from the Tax Foundation show that in 2008, the average income for the bottom half of taxpayers was $15,300.

This year the first $9,350 of income is exempt from taxes for singles and $18,700 for married couples, just slightly more than in 2008. That means millions of the poor do not make enough to owe income taxes.

But they still pay plenty of other taxes, including federal payroll taxes. Between gas taxes, sales taxes, utility taxes and other taxes, no one lives tax free in America.

When it comes to state and local taxes, the poor bear a heavier burden than the rich in every state except Vermont, the Institute on Taxation and Economic Policy calculated from official data. In Alabama, for example, the burden on the poor is more than twice that of the top 1 percent. The one-fifth of Alabama families making less than $13,000 pay almost 11 percent of their income in state and local taxes, compared with less than 4 percent for those who make $229,000 or more.

2. The wealthiest Americans don’t carry the burden.

This is one of those oft-used canards. U.S. Sen. Rand Paul, the tea party favorite from Kentucky, told David Letterman recently that “the wealthy do pay most of the taxes in this country.”

The Internet is awash with statements that the top 1 percent pays, depending on the year, 38 percent or more than 40 percent of taxes.

It’s true that the top 1 percent of wage earners paid 38 percent of the federal income taxes in 2008 (the most recent year for which data is available). But people forget that the income tax is less than half of federal taxes and only one-fifth of taxes at all levels of government.

Social Security, Medicare and unemployment insurance taxes (known as payroll taxes) are paid mostly by the bottom 90 percent of wage earners. That’s because, once you reach $106,800 of income, you pay no more for Social Security, though the much smaller Medicare tax applies to all wages. Warren Buffett pays the exact same amount of Social Security taxes as someone who earns $106,800.

3. In fact, the wealthy are paying less taxes.

The Internal Revenue Service issues an annual report on the 400 highest income-tax payers. In 1961, there were 398 taxpayers who made $1 million or more, so I compared their income tax burdens from that year to 2007.

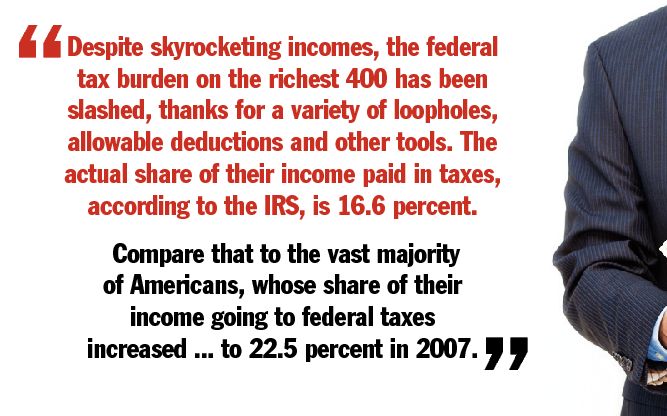

Despite skyrocketing incomes, the federal tax burden on the richest 400 has been slashed, thanks for a variety of loopholes, allowable deductions and other tools. The actual share of their income paid in taxes, according to the IRS, is 16.6 percent. Adding payroll taxes barely nudges that number.

Compare that to the vast majority of Americans, whose share of their income going to federal taxes increased from 13.1 percent in 1961 to 22.5 percent in 2007.

(By the way, during seven of the eight Bush years, the IRS report on the top 400 taxpayers was labeled a state secret, a policy that the Obama overturned almost instantly after his inauguration.)

4. Many of the very richest pay no current income taxes at all.

John Paulson, the most successful hedge fund manager of all, bet against the mortgage market one year and then bet with Glenn Beck in the gold market the next. Paulson made himself $9 billion in fees in just two years. His current tax bill on that $9 billion? Zero.

Congress lets hedge fund managers earn all they can now and pay their taxes years from now.

In 2007, Congress debated whether hedge fund managers should pay the top tax rate that applies to wages, bonuses and other compensation for their labors, which is 35 percent. That

tax rate starts at about $300,000 of taxable income; not even pocket change to Paulson, but almost 12 years of gross pay to the median-wage worker.

The Republicans and a key Democrat, U.S.

Sen. Charles Schumer of New York, fought to keep the tax rate on hedge fund managers at 15 percent, arguing that the profits from hedge funds should be considered capital gains, not ordinary income, which got a lot of attention in the news.

What the news media missed is that hedge fund managers don’t even pay 15 percent. At least, not currently. So long as they leave their money, known as “carried interest,” in the hedge fund, their taxes are deferred. They only pay taxes when they cash out, which could be decades from now for younger managers. How do these hedge fund managers get money in the meantime? By borrowing against the carried interest, often at absurdly low rates – currently about 2 percent.

Lots of other people live tax-free, too. I have Donald Trump’s tax records for four years early in his career. He paid no taxes for two of those years. Big real-estate investors enjoy tax-free living under a 1993 law President Clinton signed. It lets “professional” real-estate investors use paper losses like depreciation on their buildings against any cash income, even if they end up with negative incomes like Trump.

Frank and Jamie McCourt, who own the Los Angeles Dodgers,

have not paid any income taxes since at least 2004, their divorce case

revealed. Yet they spent $45 million one year alone. How? They just

borrowed against Dodger ticket revenue and other assets. To the IRS,

they look like paupers.

In

Wisconsin, Terrence Wall, who unsuccessfully sought the Republican

nomination for U.S. Senate in 2010, paid no income taxes on as much as

$14 million of recent income, his disclosure forms showed. Asked about

his living tax-free while working people pay taxes, he had a simple

response: everyone should pay less.