George Dinges trusted Susan Satterlee with every aspect of his Springfield-based business when he hired her 10 years ago as his operations manager. He would later find out she stole $2.5 million from his business over the course of more than five years.

“I placed a lot of trust in Susan,” Dinges said. “That violation of trust is something I will never forget.”

In November, Satterlee pleaded guilty to money laundering, wire fraud and filing a false tax return in connection with an embezzlement scheme that ran from 2009 to 2015. At Satterlee’s sentencing hearing on April 12, Dinges testified about the emotional and physical toll of her crimes, asking for her to receive the maximum sentence. Through tears, Satterlee begged for forgiveness before being sentenced to nearly four years in federal prison. In addition, she’ll have to repay more than $3 million to Dinges, the IRS and an insurance company.

“You are worse than a highwayman who pulls his pistol and says, ‘Stand and deliver,’ ” U.S. District Court Judge Richard Mills told Satterlee as he handed down the sentence. “How you can have done what you did is absolutely staggering. You have so much to repay, not just in currency, in money; you have to repay trust and friendship.”

Satterlee declined to comment through her attorney, federal public defender Douglas Quivey.

Dinges hired Satterlee in 2006 to help with his social services consulting firm in Springfield, and he told Mills at the sentencing hearing that she became like another member of his family. She was paid $62,000 per year in the job, plus bonuses of up to $40,000 per year. Little did Dinges know that as early as 2009, Satterlee began siphoning money from his business account into her personal bank account.

The theft continued for more than five years, going unnoticed until March 2014, when someone alerted the FBI to a pattern of large check deposits from the company’s account into Satterlee’s account, followed by large wire transfers to casinos and large cash withdrawals from her account. Shortly after the FBI investigation began, Satterlee posted several photos on her Twitter account from the Academy of Country Music Awards in Las Vegas.

It’s unclear from court records why Dinges didn’t notice the money missing sooner. He declined to be interviewed.

The affidavit filed against Satterlee by an FBI agent in Springfield says that when the FBI interviewed Dinges on Aug. 7, 2014, Dinges said he had learned of the transfers when Illinois National Bank alerted him. According to the affidavit, Dinges told the FBI that Satterlee confessed when he confronted her in the presence of a witness, and he fired her on July 31, 2014.

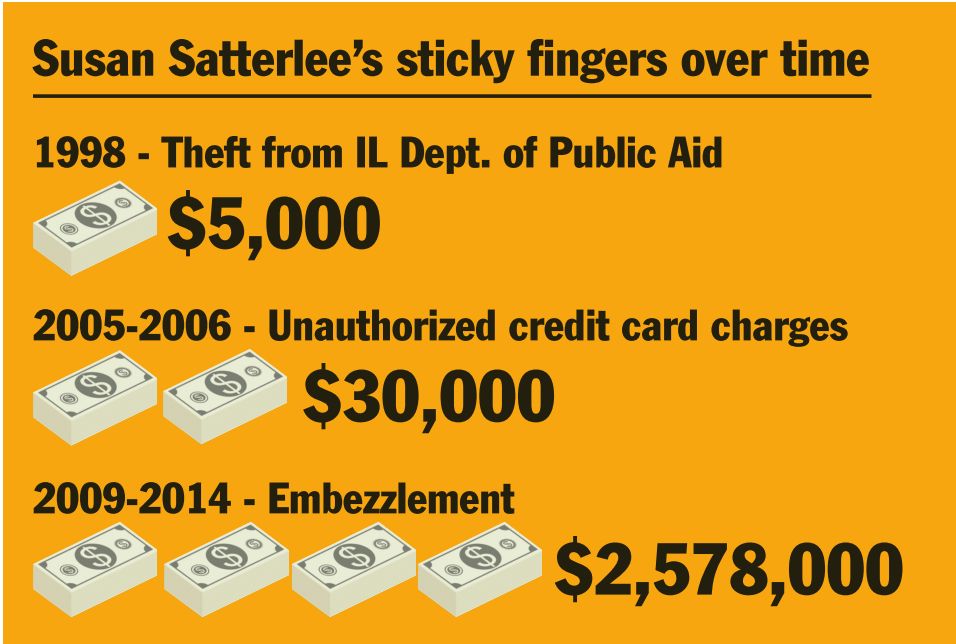

Between

June 2009 and July 2014, Satterlee embezzled more than $2,578,000 from

the company, according to court records. More than $1 million of that

went to various casinos, while Satterlee withdrew about $400,000 in cash

and used another $400,000 to pay her credit card bills and other debts.

The FBI confronted Satterlee about the transfers on Sept. 4, 2014, the same day Satterlee executed a “quit claim deed” on her former home at 189 East Andrew Road in Springfield, signing the house over to her husband, John Satterlee. They ultimately sold the house and the associated 12.5 acres of land for $371,000 in July 2015.

Satterlee apparently still had access to the company accounts even after being fired and confronted by the FBI. In February 2015, Dinges discovered new transfers to Satterlee’s account, dating back to December 2014 – five months after Satterlee was fired and three months after the FBI confronted her. In total, Satterlee had transferred another $28,884 out of the company account, spread over 29 payments that went toward paying off her credit card debt and cellphone bill. The FBI affidavit says those payments were not automatic payments that had been set in advance.

In November 2015, Satterlee pleaded guilty to wire fraud, embezzlement and filing a false tax return. An FBI affidavit says Satterlee didn’t report more than $951,727 in income from the embezzled funds on her 2013 tax return and consequently owes the IRS nearly $341,000 in unpaid income tax.

During Satterlee’s sentencing hearing, Dinges asked Mills to give her the maximum sentence of 57 months, which is just short of five years. Dinges testified that the theft had cost him time, money and “many, many sleepless nights.”

“Not a day has gone by when I have not thought about this,” Dinges said.

He said that Satterlee never apologized to him prior to the sentencing hearing, and the theft went on “for years and years.” Most of all, he said, his sense of trust was harmed by the personal nature of the theft.

“This theft was from me, not from a big corporation,” he said. “The money came right out of my pocket, so it was very personal to me.”

U.S. Attorney Timothy Bass told Mills that Satterlee’s theft from Dinges wasn’t her first brush with financial crime. She was previously charged with a felony for defrauding the former Illinois Department of Public Aid, Bass said. Sangamon County court records show Satterlee pleaded guilty to a lesser charge of misdemeanor theft in that 1998 case and was ordered to pay $4,955 in restitution to the state agency.

Bass noted that Satterlee continued her theft from Dinges even during preindictment talks with the government.

“The only thing that stopped her was her arrest,” Bass said, referring to Satterlee’s arrest on March 12 by the FBI.

Satterlee asked Mills for leniency, reading from a prepared statement as tears welled in her eyes. She apologized to Dinges, his family and her own family. She said she accepts responsibility for her actions and feels “extreme guilt and remorse.”

“I was the rock of this family, and they thought I was this perfect person,” she said. “I let them down.”

Satterlee attributed her behavior to a gambling addiction that she said she developed after the back-to-back deaths of her sister and her stepfather, in addition to empty nest syndrome.

“I eventually realized I couldn’t stop; I could not regain control of my behavior,” she said. “I knew I was destroying myself.”

Satterlee told the court that she will work to get signs on gambling addiction posted at gaming machines and try to help other companies prevent embezzlement. She said she now attends a Gamblers Anonymous support group twice each week, adding that her recovery coin means more to her than any other achievement in her life.

Mills ultimately sentenced Satterlee to 46 months in prison for money laundering and wire fraud, plus a second sentence of 36 months in prison for filing a false tax return. The two sentences will run concurrently, meaning Satterlee will effectively serve only the longer sentence. It represents the bottom of the range provided by sentencing guidelines.

Mills

allowed Satterlee to self-report to the federal Bureau of Prisons at

the notice of the U.S. Marshall’s Office, meaning she is currently free.

Before she begins her federal prison sentence, however, she must attend

a separate sentencing hearing on June 9 at a state court in Nevada,

where she pleaded guilty to passing a bad check with intent to defraud.

She was originally charged with two counts of passing bad checks and two

counts of theft in August 2014. The Clark County District Attorney’s

Office, which covers Las Vegas, did not respond to a phone message

seeking comment.

Despite remaining free

to attend her sentencing in Nevada, on May 10 Satterlee submitted a

request with the Clark County court to waive her appearance for the

hearing.

Two casino companies in Las Vegas sued Satterlee over the past year, but it’s unclear from the court docket how much money was involved or whether those cases prompted the criminal charges in Nevada. An attorney for LVHR Casino LLC, which owns multiple casinos, said he could not comment. An attorney for the MGM Grand and Mandalay Bay casinos, which are owned by the same company, did not return a phone message seeking clarification.

In addition to her prison sentence, Satterlee will be required to undergo treatment for gambling addiction. After her release from prison, she will be required to serve three years of probation and repay the stolen money. Fifty percent of Satterlee’s disposable income after her release will go to repaying the funds, Mills said. He also required her to commit no crimes involving substance abuse during probation, take on no credit cards or other debt over $500 without court approval and avoid working in any industry in which she would handle cash or other financial instruments. Mills said if Satterlee shows significant progress after the first two years of her probation, he would consider waiving the third year.

The prior fraud

The case comes as little surprise to Doug and Lisa Simmons. They’re still recovering a decade after John and Susan Satterlee ran up a mountain of debt in their name.

In December 2004, roughly two years before Susan Satterlee began working for George Dinges, Doug and Lisa Simmons formed a business partnership with John and Susan Satterlee to open a now-defunct batting cage business called The Cages of Chatham. Doug Simmons opened a credit card for the business under his name, and the Satterlees ran the day-to-day operations. Before long, Doug and Lisa began seeing red flags like frequent complaints from customers and Susan Satterlee getting indignant when anyone asked about the business’ finances.

The Simmonses transferred all of their interest in the business to the Satterlees in June 2005. However, the credit card in Doug Simmons’ name remained open.

“There was no reason for us to ever doubt or believe they had anything but good intentions,” Doug said.

From April 2005 to November 2006, the Satterlees ran up more than $30,000 in unauthorized charges on the card, according to court documents in the Satterlees’ 2007 bankruptcy. The documents also say that the Satterlees surreptitiously changed the billing address on the credit card to hide the charges.

One day in December 2006, Doug came home from work and got a phone call from American Express, telling him he was being held liable for the charges. The company threatened to send the debt to collections if he didn’t pay within 48 hours.

“Overwhelming is an understatement for how we felt,” Doug said, adding that he tried to contact the Satterlees, to no avail.

Doug obtained a copy of the charges, which included trips to Florida, bicycles, Old Navy shopping sprees, groceries, gas and more, totaling around $38,000.

“We were just in awe,” he said. “I felt sick.”

The Simmonses had to take out a second mortgage on their house to pay down the debt. Doug says he could have pressed charges for fraud, but he just wanted to be paid back.

In exchange for the Simmonses not pressing charges, the Satterlees signed a promissory note in January 2007 agreeing to pay back the money. By March of that year, however, they had defaulted on the note. When the Satterlees filed for bankruptcy in October of that year, Doug and Lisa had to fight to make sure the debt wasn’t discharged.

“It has been a struggle every month throughout the years to collect this debt,” Doug says, describing constant attempts by the Satterlees to evade payment.

Court

records show John and Susan Satterlee filed for bankruptcy in 2003,

2006, 2007 and 2015. The couple’s 2015 bankruptcy filing shows

more than $226,600 in total income over the preceding two years. The

filing also lists more than $3.3 million of income attributed to Susan

Satterlee’s embezzlement, IRA distributions and gambling winnings. In

total, the couple owed more than $1 million to American Airlines, credit

card companies, collections agencies, retail shops like Macy’s and Pier

1 Imports, student loans and casinos.

Doug says the Satterlees still owe him and Lisa about $3,800 of the original debt. That’s not counting the steep interest the Simmonses paid on the second mortgage they used to pay off the fraudulent credit card debt.

“It has been a long nine years,” Doug said.

“It goes without saying that we’ve been put through the ringer.”

Like George Dinges in Satterlee’s current case, Doug Simmons describes a major loss of trust from his experience. He doesn’t believe Satterlee’s claim that a gambling addiction is to blame for her embezzlement from Dinges.

“How can that be?” he said. “There is evidence that stems back from well before this current case that it had nothing to do with gambling. That’s a very bitter pill for me to swallow. It’s nothing more than an excuse – a scapegoat – and an absolutely absurd one, at that.”

Contact Patrick Yeagle at [email protected].