Payday loan law doesn’t apply to TitleMax

GOVERNMENT | Bruce Rushton

Debate over short-term loan businesses on MacArthur Boulevard has erupted anew three years after the Springfield City Council restricted the proliferation of businesses that profit from making installment loans.

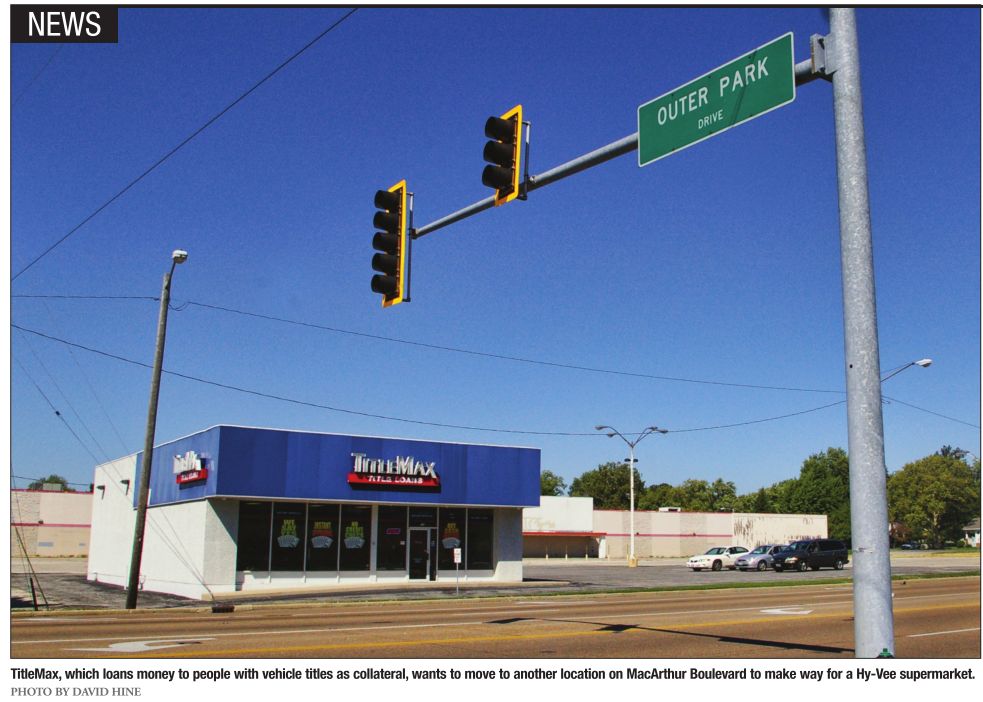

At issue is what constitutes a business subject to the city’s ban on loan establishments locating within 1,500 feet of like businesses on a decaying section of MacArthur Boulevard. The city hopes to rejuvenate the commercial strip with the help of a new taxincrement financing district formed to aid development of a proposed Hy-Vee supermarket at the site of a long-closed K-Mart.

TitleMax, which loans money to folks with motor-vehicle titles as collateral, must move to make way for the new supermarket. But the Springfield building and zoning department initially rejected a TitleMax application for a building permit to allow a move to the nearby Town and Country shopping center, also on MacArthur Boulevard.

Zoning officials rejected the application due to the 2009 ordinance, which was passed after several installment-loan businesses set up shop on MacArthur. But Mayor Mike Houston points out that the city ordinance applies to payday loan operations as defined by the state. It turns out that loans involving collateral such as vehicle titles are different than loans made in exchange for a check post dated to the date a borrower gets a paycheck, at least so far as the state is concerned.

“At the time that the ordinance was passed there was no consideration given to businesses that accept collateral,” Houston wrote in an email response to questions. “Therefore, there would be no provisions that would prevent TitleMax from moving across the street (Outer Park Drive) from its present location.”

Houston also said that he would “certainly be willing to work with any aldermen who would like to broaden the scope” of the ordinance. Whether the city council would want to revisit an issue that proved contentious during the last go-round isn’t clear.

The council rejected the proposal in the fall of 2008, but it was resurrected four months later, with aldermen still split and former Mayor Tim Davlin casting the deciding vote while opponents argued that the measure would restrict business growth.

Ward 6 Ald. Cory Jobe, who pushed for restrictions on installment-loan businesses while head of the MacArthur Boulevard Business Association prior to winning his council seat, said that he hasn’t spoken with colleagues on the council about amending the ordinance, but it could be a hard sell. He said that he believes that the city should enforce the spirit of the law. The measuring stick, he said, should be high interest rates.

“I consider TitleMax to be just like another loan-store operation that was intended to be addressed under this ordinance,” Jobe said. “I think we should enforce the law as it was intended to be enforced. … In the spirit of the ordinance, we never dreamed of TitleMax being out of it.”

In a recent email to city zoning officials, however, James Zerkle, an attorney who is one of the owners of Town and Country, wrote that TitleMax has a lease with the shopping center and the city could be on the hook for economic losses if a building permit is improperly denied. He could not be reached for comment.

Like Jobe, Ward 7 Ald. Joe McMenamin said that the distinction between payday loan operations and title-loan businesses came as a surprise.

“It’s kind of a new question,” McMenamin said.

McMenamin, who is a lawyer, said that it is likely too late for the city to stop TitleMax from moving. He said title-loan businesses provide a service in that borrowers rejected by conventional banks can get lower interest rates than offered by payday loan stores. But he didn’t reject revisiting the ordinance.

“I’m really open-minded on the issue,” McMenamin said.

Contact Bruce Rushton at [email protected].