THR and its owner face lawsuits, bad checks

BUSINESS | Bruce Rushton

THR and Associates says it will make good on thousands of checks written on an account that was unexpectedly closed last week.

Meanwhile, the Springfield-based company and its owner, Jeffrey Parsons, who owes more than $3.5 million in delinquent federal taxes, are facing lawsuits, including one filed by employees who say that the company has violated federal labor law by not paying overtime and promised salaries.

Matthew Enright, company spokesman, said that employees who are suing have been appropriately paid.

“It’s just a lawsuit,” Enright said. “People get sued every day.”

This is not the first time that an entity controlled by Parsons has been accused of shortchanging workers. In a 2005 lawsuit, the state attorney general alleges that Parsons violated consumer fraud and deceptive business practices laws by recruiting managers to sell fireworks but not paying them as promised when he ran a now-defunct company that declared bankruptcy.

The state’s lawsuit is still active in Sangamon County Circuit Court. So is a federal lawsuit filed by WGBH Educational Foundation, producer of the television show “Antiques Roadshow,” which alleges that THR violated trademarks and engaged in false advertising by using the name Treasure Hunters Roadshow when purchasing valuables from consumers during buying events at hotels throughout the nation.

The WGBH lawsuit was settled in September, with THR agreeing to give $150,000 to the foundation, limit its use of the word “roadshow” and include disclaimers in advertising. In December, WGBH went back to court, alleging that THR had violated several terms of the settlement agreement. On Tuesday, the parties reached a new settlement, with THR and Parsons agreeing to pay an additional $165,000 to the foundation.

Enright confirmed that as many as 4,000 checks written to employees, vendors and customers who sold valuables to the company didn’t clear last week because PNC Bank unexpectedly closed THR’s account. It’s not clear why, but Enright said that lawyers for THR are looking into the matter. The company has sufficient funds to make everyone whole, Enright said, and is contacting people who are owed money. He said that everyone that the company has been able to contact has been issued new checks.

Carl Buck, THR attorney, said he didn’t know why PNC closed THR’s account.

“I would only be guessing,” Buck said. The Internal Revenue Service in December filed a lien of nearly $3.2 million against Parsons for unpaid 2010 income taxes. During a January hearing in his pending divorce,

Parsons, THR’s sole shareholder, testified that he expected to have a similar tax liability for 2011, and he acknowledged paying six figures in penalties for delinquent federal payroll taxes last year. He testified that he earned $8.8 million in 2010 and paid $44,000 in taxes that year but did not have a bank account in his own name until late last year.

In addition to the December lien, the IRS last June filed a $494,854 lien against Parsons for unpaid taxes. More recently, the IRS on April 17 filed a lien of more than $1.3 million against THR and Associates.

Enright said he did not know why THR was late with payroll taxes, and he wasn’t familiar with the lien filed last month. “I don’t know anything about that, to be completely honest,” Enright said.

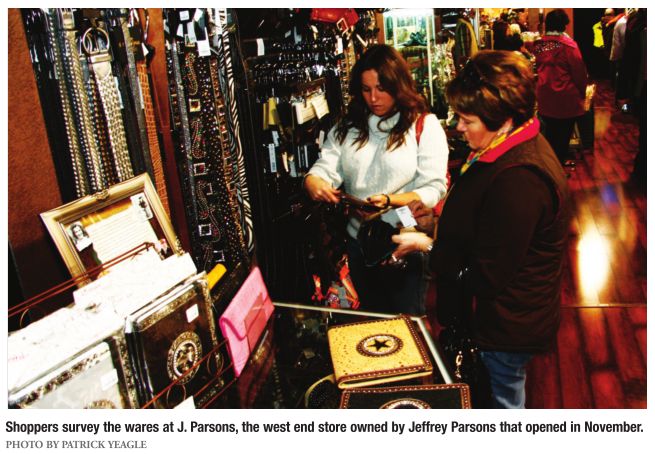

From the witness stand, Parsons in January was upbeat about his business ventures, which include a west side store called J. Parsons that opened in November and sells clothing, food, toys and accessories, including jewelry and watches. THR recently opened a store called Buy Sell Trade on North Grand Avenue and another in Jacksonville, but a Bloomington store has opened and closed since the hearing.

Parsons in January corrected Peggy Ryan, his estranged wife’s lawyer, when he was asked about buying an airplane.

“It’s a jet, actually,” Parsons testified. Parsons testified that THR paid for a share of the Cessna 650 with $600,000 in silver coins. He said that the company used silver to pay a $100,000 “non-refundable service fee” in connection with a Panther Creek home that THR acquired in November with a two-year lease agreement that includes a purchase provision at a price of slightly more than $1 million.

Parsons said that he would live in the home.

“I feel like I work hard and deserve a nice residence,” Parsons said.

Parsons said the jet is for business use, testifying that he uses the aircraft to pick up goods purchased in states that don’t allow merchandise purchased by traveling companies such as THR to immediately move outside state borders; Enright says that THR uses the plane to transport employees. Parsons also testified that a Bentley automobile was purchased as an investment, as was property in Pike County where THR is building a hunting lodge.

Parsons testified that the days of THR traveling the country buying goods in hotels are numbered.

“I think that has a shelf life of a few more years,” Parsons said. “At some point, we may become over-saturated. … We’re going to open J. Parsons (stores) elsewhere. We want to host those events right in our store. We’ll have credibility because we’ll be an established business in Springfield.”

After testifying about his business ventures and finances for more than two hours, Parsons the next day reached an agreement with his estranged wife, saying that he would limit personal spending to $25,000 a month and put $140,000 a month into escrow. He also agreed not to acquire any real estate or motor vehicles, boats or aircraft without court permission.

Numerous attempts to interview Parsons after the hearing proved unsuccessful. On Monday, Enright said that Parsons would not speak with a reporter.

Contact Bruce Rushton at [email protected].