Ponzi scheme benefited Senate Dems’ lawyer

Victims demand $160,000 from scheme operator’s son FRAUD | Rachel Wells

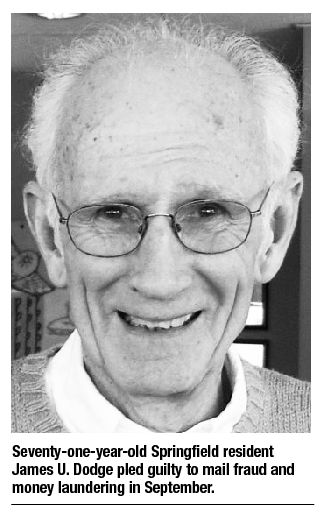

Victims of Springfield Ponzi scheme operator James U. Dodge are calling for his son, a lawyer for the Illinois Senate Democrats, to pay back the money gained from the scheme that his father spent on him and his family. Dodge’s son, James W. Dodge, serves as deputy legal counsel for the Illinois Senate Democrats, specializing in criminal law and executive appointments, and has worked for the Illinois Senate since 2003.

A plea agreement entered in September names the younger Dodge and his family as the beneficiaries of $160,000 that James U. Dodge took from Springfield residents and their friends while posing as a successful day trader. James U. Dodge told investors that by using a special “algorithm” he could guarantee three-percent monthly returns, or 36 percent on an annual basis. According to the affidavit filed by IRS investigators, James U. Dodge accepted more than $5.1 million in principal from more than 50 people. After Dodge paid back some of that principal, some with interest, the net loss to investors was just over $2 million.

James U. Dodge invested only about 22 percent of the cash he accepted, but even on those investments he lost money. He used the rest of the funds he solicited to pay back earlier investors and for personal expenses. According to the plea agreement, those expenses included James W. Dodge’s son’s tuition at Culver Military Academy, a private boarding school in Indiana.

James U. Dodge also used his son James W. Dodge’s name when telling investors they could cash in on the elder Dodge’s life insurance plans should anything happen to him before their investments were returned. The two insurance policies, pledged for nearly $2.5 million in investments, were worth only a total of $1 million. Public documents show no indication that James W. Dodge knew about the policies or his father’s scheme.

“Although I’m not accusing him of being involved in the Ponzi scheme himself, he did receive benefit,” says Lin Brown. She says that she and her husband, Ed, who was a friend of James U. Dodge for 44 years, invested $53,000, all of which they lost because they chose to roll over the three percent monthly interest they thought they were earning. “He [James W. Dodge] was the only person named in the plea agreement who received any money. … Part of that is my money.”

A handful of other investors received money in excess of what they invested with the elder Dodge. Their names are not public record. Assistant U.S. Attorney Patrick Hansen is requesting that those investors voluntarily return any gains, as they were paid at later investors’ loss, spokeswoman Sharon Paul says. No legal action has been taken to recover those funds at this time.

Asked if James W. Dodge would be asked to return the $160,000 or if legal action would be taken to recover those funds, Paul said she could not comment, as James U. Dodge’s case is still ongoing. The elder Dodge’s sentencing hearing is scheduled for Jan. 13, 2011. Paul says James W.

Dodge has not been charged with any wrongdoing.

Regardless, Brown says that, as a person in a position of public trust, James W. Dodge should volunteer to return the funds, which she calls “ill-gotten.”

In an e-mailed response to Illinois Times’ request for an interview, James W. Dodge stated: “My heart goes out to everyone who has been hurt by this. This has been hard on my wife and children, and out of respect for their privacy I prefer not to comment further.”

Sen. Deanna Demuzio, whom Brown contacted regarding the matter, and Sen. President John Cullerton in e-mailed statements both cited the pending federal case and declined to comment further.

Contact Rachel Wells at [email protected]