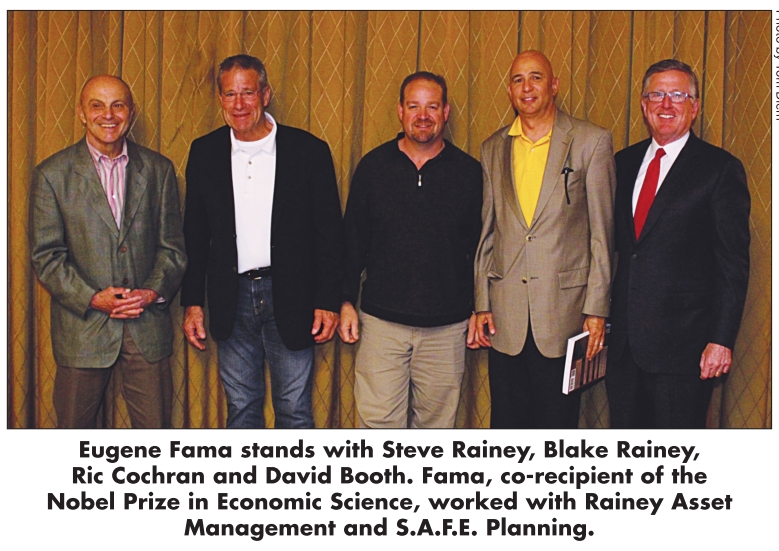

Financial coaches have ties to Nobel Prize winner

The work of the 2013 Nobel Prize in Economic Science co-recipient, Eugene F. Fama, reverberates even in Shreveport.

A University of Chicago professor, Fama shares the Nobel Prize for economics with two other recipients, professor Lars Hansen, also at the University of Chicago, and professor Robert Shiller at Yale. Considered the “father of modern finance,” Fama’s research has impacted investors all over the globe, including Shreveport-based financial advisers Steve Rainey, Blake Rainey and Ric Cochran, of Rainey Asset Management and S.A.F.E. Planning.

The three local RAM associates have for years not only managed portfolios based in large part on Fama’s work, but they have also conducted workshops on his methods.

“It was gratifying to see professor Fama receive the recognition he deserves,” Steve said. “We’ve been beating the drum for years that speculating is a loser’s game, that diversification is your friend and that certain asset categories tend to outperform over time.”

In addition to his work on efficient markets, Fama is credited along with Dartmouth professor Kenneth French with devising the Three Factor Model, identifying certain asset classes that tend to outperform over time. Steve, Blake and Cochran believe that work could lead to Fama and French also sharing a Nobel Prize in the future.

The RAM associates recommend the model of Mark Matson, founder and chief executive officer of Matson Money Inc., a Cincinnati-based investment adviser firm managing more than $4.7 billion (as of November 2013) for investors nationwide.

Matson has been using Fama’s theory on efficient markets for more than 20 years.

“I met Fama through Matson,” said Steve, who recalled first meeting the Nobel Prize winner last year in Austin during a taping for a PBS special on Matson’s program, “Main Street Money.”

Matson has built his portfolio using the efficient market theory that Fama developed. The basic premise is no one can predict a move in stocks or prices because everything that is known and knowable about a stock is already factored into its price.

Thus, the idea that the market is efficient renders trying to predict the market a fruitless endeavor.

“If you’re trying to pick stocks, or time the market, you’re just gambling and speculating you’re your money,” Steve said. “Of course, Wall Street gets rich off of that.”

Aside from the idea of efficient markets, RAM, which offers fee-based financial planning, takes another leaf from Matson’s book and offers clients coaching.

“We don’t serve as investment advisers,” Steve said. “We serve as coaches.” And they coach their clients to understand a number of factors involved in investing.

“What we coach our people to do is to understand that market corrections will come, and when they come, my job is to keep [clients] from panicking, from selling out low and sitting on the sidelines until the market recovers, and buying back in high,” Steve said. “That’s exactly the opposite of how to make money.”

First, investors should understand the amount of risk they can tolerate, a factor that is different for each investor. A second principle is that investors should stay the course. Thirdly, investors should broadly diversify, hold on, and then rebalance on a regular basis. Matson’s portfolio is designed so that an individual investor’s portfolio is adjusted automatically based upon a predetermined risk tolerance.

“It’s always buying low and selling high,” Steve said.

A fourth principle RAM coaches is to take fear and greed and other emotions out of investing.

All RAM clients go into Matson’s portfolio. The only decisions that clients make are the allocations between fixed income and equities. In addition, clients receive monthly coaching.

–Tammy Sharp