AS REPORTED BY THE US DEPARTMENT OF AGRICULTURE

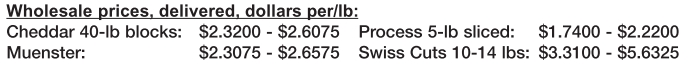

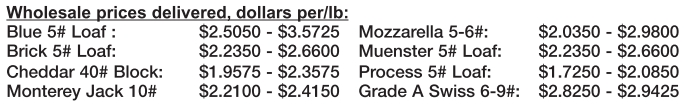

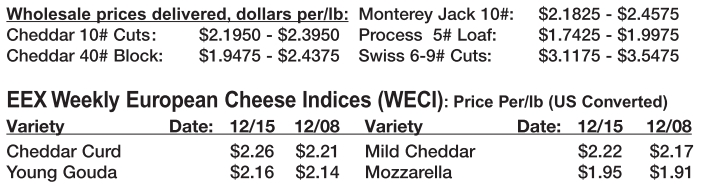

WHOLESALE CHEESE MARKETS

NATIONAL - DEC. 23: Cheese inventory reports range from accessible to limited, and vary by region and plant to plant. Production is running as expected. Some plant managers plan to run a very active holiday schedule, as they clear markedly more spot milk loads this week due to the discounts, while others say they are taking some holiday downtime. Contacts view the cheese market tone with some trepidation based on the current price gap.

NORTHEAST - DEC. 29: Milk supplies are available for Class III production. Cheesemaking is active in the region, although some facilities will take a production break for the holiday.

Inventories are sturdy, and cheese is available for spot and contract needs. Retail sales are strong; recent reports suggest grocery shoppers still have healthy appetites for cheese. As Omicron variant uncertainties persist and case counts climb, foodservice demand is said to be faltering. Spot market activities have been quieter during year-end, holiday-shortened trading weeks. Through Tuesday of this week, cheddar block prices shifted higher on the CME group, while barrel prices sank beneath last week’s average.

MIDWEST AREA - DEC. 29: Some

Midwestern cheese makers are very busy during the holiday season as

spot milk prices are falling at somewhat strong discounts, which are

expected in the culminating weeks of any year. Spot milk prices are from

$4 to $2 under at report time. Although discounted, spot milk is

somewhat pricey compared to the final week in 2020. Last year’s spot

milk prices reached $10 under Class III during week 53. Cheese demand

has maintained strength coming into the holiday season. Now, there are

some questions as to how cheese stocks will hold up once customers come

back to the table in early 2022. Despite a relatively large gap between

block and barrel prices on the CME, there are some near term bullish

market undertones according to cheese market actors.

WEST - DEC. 29: Demand

for cheese is steady in retail markets, while foodservice sales are

declining. Contacts say that rising COVID cases in the region and winter

school closures are contributing to a decline in foodservice

purchasing. Demand for cheese in international markets is strong. The

ongoing shortage of truck drivers has been exacerbated by the holidays

and poor weather, increasing delays to deliveries of loads. Export loads

of cheese are facing further delays due to port congestion. Spot

availability for cheese barrels and blocks is unchanged. Milk is

available for production in the region, though some contacts report

difficulty with moving loads in areas hit with bad weather. End of year

holidays, staffing shortages, and shipping delays are contributing to

reduced cheese production schedules.

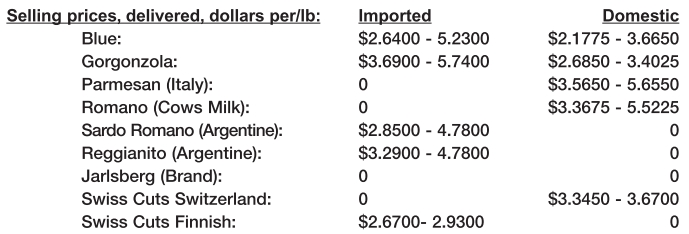

FOREIGN -TYPE CHEESE - DEC. 29: Western

European cheese manufacturers are pleased with the staying power of

what they classify as near-record cheese prices. Manufacturers are also

exhausted by the stress of fielding customer orders they cannot fill, as

well as by many customer calls cutting or delaying shipments. The

firmness of cheese markets now is considered far greater than the end of

recent previous years. Almost all scheduled January 2022 cheese

production is already sold. While the pace of activity this last holiday

week of the year is typically slower, the stress of unmet demand is

expected to resume next week.