AS REPORTED BY THE US DEPARTMENT OF AGRICULTURE

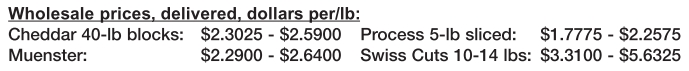

WHOLESALE CHEESE MARKETS

NATIONAL - DEC. 10: Some Midwestern plant managers relay they are hopeful for holiday milk discounts, as buying interest has been very busy and production is somewhat active. Milk availability in the region compared to last year’s $8 to $4 under Class price range shows a somewhat clear difference year over year. Class I intakes are reportedly much stronger this year than last year’s atypical pandemic situation, but some contacts say retail demand is stronger than even in previous years to 2020, therefore milk is being spread out, which could tighten things up moving into football playoffs, a seasonally busy season particularly for pizza and snack style retail cheese makers. Current cheese stores are balanced, but with lighter milk relative to recent years and generally strengthening demand notes, some contacts foresee tighter cheese availability.

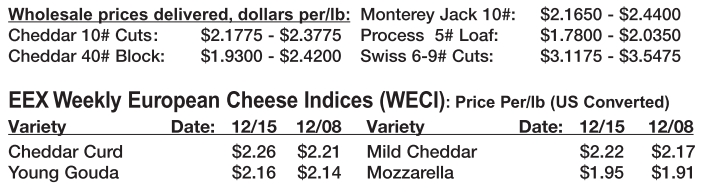

NORTHEAST - DEC. 15: Milk supplies are tighter in the Northeast, but steady volumes are clearing to Class III. Cheese makers are keeping active production schedules. Cheese inventories are available to meet steady to stronger demand across sectors. Foodservice orders are fairly firm for now. Some sources suggest, however, that restaurant dine-in numbers may be starting to waver ever so slightly as Omicron uncertainties loom. Retail cheese sales are healthy. Some grocery stores are featuring various cheese promotions in weekly circulars, and recent reports indicate that more cheese is moving through checkout lines this holiday season than in 2019 or 2020.

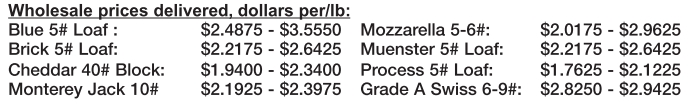

MIDWEST AREA - DEC. 15: A

number of cheese makers in the Midwest say retail orders are very busy.

Curd and barrel producers, particularly, relay strong demand and

limited supplies and do not foresee a change in upcoming weeks. After

some regional plants were closed for maintenance last week, contacts say

plants are running hard with adequate, but not abundant, staffing

numbers. Spot milk is at similar pricing to last week, at Class III to

slightly over. That said, some cheese plant managers say they are

already getting offered milk for the upcoming holiday weeks at slight

discounts.

WEST - DEC. 15: Steady

demand for cheese is present in both retail and foodservice markets.

International demand for cheese is strong. Contacts report notable

interest in loads of cheese for export to Asian markets. Port congestion

is causing delays to loads intended for international markets. A truck

driver shortage is also contributing to load delays in the region.

Cheese block inventories have been tight in recent weeks and are,

reportedly, tightening. Spot availability of cheese barrels is

unchanged. Cheese producers are running busy schedules in the region, as

milk continues to be available for production.

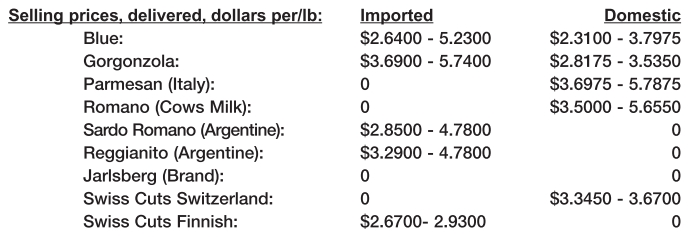

FOREIGN -TYPE CHEESE - DEC. 15: There’s

a tense atmosphere surrounding hard cheese transactions. Buyers want

more than cheese manufacturers can deliver. Cuts are made to existing

orders; this causes upsets for buyers. Sellers say cuts are unavoidable

considering output and the stock of cheese on hand. There is no holiday

joy in the efforts to juggle stocks to try filling the very high demand

for Western European cheese.