AS REPORTED BY THE US DEPARTMENT OF AGRICULTURE

WHOLESALE CHEESE MARKETS

NATIONAL - DEC. 3: Some cheese market contacts relay that the Omicron variant has not yet deterred restaurant sales. Foodservice demand remains firm in the Northeast.

Cheese makers are working through still-available holiday milk surpluses, although staffing shortages remain at the forefront of management concerns. Western contacts say foodservice and retail demand are very healthy ahead of the holiday season. They also sayport congestion has worsened in recent weeks. Cheese market tones are slowly improving.

NORTHEAST - DEC. 8: Northeastern milk production has leveled off somewhat this week, but cheese makers are generally receiving adequate supplies to maintain active production schedules. Cheese inventories are available to meet steady to stronger customer orders across sectors. Market participants expect upcoming celebrations will keep seasonally elevated retail cheese sales lofted for a few more weeks. Once the holidays are in the rearview mirror, however, contact forecasts are varied. Foodservice demand is fairly steady overall, though recent reports suggest that news of the Omicron variant may be contributing to reduced dine-in numbers at restaurants in some locales.

MIDWEST AREA - DEC. 8: Cheese

makers say spot milk offers are quiet, as milk prices have shifted

higher after the holiday and post-holiday influx of spot milk. Even as

multiple plants in the region are closed for maintenance, others are

running busily. Staffing shortages, at least according to some plant

managers, have slowly but surely begun to improve. Cheese demand is

busy, meeting seasonal expectations. Some plant managers say they are

likely not going to catch up on orders until the onset of 2022, when

demand is expected to settle. Cheese inventories are available here and

there for spot market movements, but inventories are not overly

concerning. Cheese market tones remain uncertain, but they are slowly

gaining momentum as barrel prices edge higher to meet mostly steady

block prices on the CME.

WEST - DEC. 8: Demand

for cheese in retail markets is steady. Foodservice demand is,

reportedly, trending higher in the West. International demand for cheese

is strong; contacts note steady purchasing for export to Asian markets.

Port congestion and a shortage of truck drivers are causing delays to

loads of cheese. Spot purchasers say that cheese barrel inventories are

tightening, while block spot availability is unchanged. Milk is

available for production in the region, allowing cheese producers to run

busy schedules.

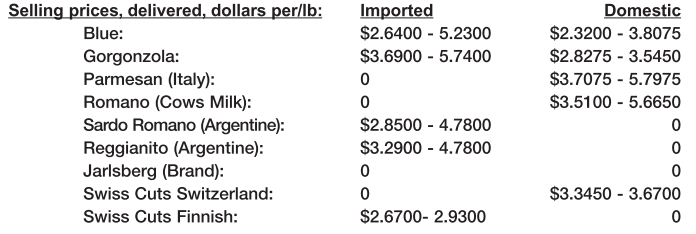

FOREIGN -TYPE CHEESE - DEC. 8: Most

anticipated January cheese production is already scheduled in Germany

and France. With production as planned, some potential buyers have been

unable to finalize contracts due to the lower than desired volumes

planned.

Current

production from manufacturers is committed. In fact, the order of the

month is cuts and deletions from contracts already on the books. There

is not enough cheese to satisfy all buyers. This situation is expected

to continue at least through the first quarter of 2022. The result is

firmed prices for buyers of cheese from Western Europe. Manufacturers

hold the cards during negotiations.