TIP OF THE WEEK

Popular tax breaks for 2018 returns

Tax deductions and tax credits can be huge money-savers — if you know what they are, how they work and how to pursue them.

A tax deduction is a dollar amount that the IRS allows you to subtract from your adjusted gross income, or AGI, making your taxable income lower. The lower your taxable income, the lower your tax bill.

A tax credit is a dollar-for-dollar reduction in your actual tax bill. A few credits are refundable, which means if you owe $250 in taxes but qualify for a $1,000 credit, you’ll get a check for the difference of $750. (Most tax credits, however, aren’t refundable.)

Generally, there are two ways to claim tax deductions: Take the standard deduction or itemize deductions. You can’t do both.

THE STANDARD DEDUCTION

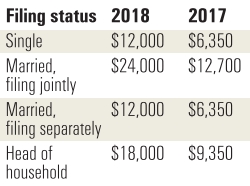

The standard deduction basically is a flat-dollar, no-questions-asked reduction in your AGI. The amount you qualify for depends on your filing status.

People over 65 or who are blind get a bigger standard deduction.

ITEMIZING DEDUCTIONS

Itemizing lets you cut your taxable income by taking any of the hundreds of available tax deductions you qualify for. The more you can deduct, the less you’ll pay in taxes.

Should you itemize or take the standard deduction? Here’s what the choice boils down to:

• If your standard deduction is less than the sum of your itemized deductions, you probably should itemize and save money. Beware, however, that itemizing usually takes more time, and you’ll need to have proof that you’re entitled to the deductions.

• If your standard deduction is more than the sum of your itemized deductions, it might be worth it to take the standard deduction (and the process is faster).

Note: The standard deduction went up in 2018, so you might find that it’s the better option for this year even if you itemized last year.

Your tax software or tax advisor can run your return both ways to see which method produces a lower tax bill.

POPULAR DEDUCTIONS AND CREDITS FOR INDIVIDUALS

• Student loan interest deduction: Deduct up to $2,500 from your taxable income if you paid interest on your student loans.

• American Opportunity Tax Credit: This lets you claim all of the first $2,000 you spent on tuition, books, equipment and school fees — but not living expenses or transportation — plus 25 percent of the next $2,000, for a total of $2,500.

• Lifetime Learning Credit: You can claim 20 percent of the first $10,000 you paid toward tuition and fees in 2018, for a maximum of $2,000. Like

the American Opportunity Tax Credit, the Lifetime Learning Credit

doesn’t count living expenses or transportation as eligible expenses.

You can claim books or supplies needed for coursework.

• Child and dependent care tax credit: Generally,

it’s 20 to 35 percent of up to $3,000 of day care and similar costs for

a child under 13, an incapacitated spouse or parent, or another

dependent so you can work — and up to $6,000 of expenses for two or more

dependents.

• Child tax credit: This could get you up to $2,000 per child and $500 for a nonchild dependent.

• Adoption credit: For the 2018 tax year, this item covers up to $13,840 in adoption costs per child.

• Earned Income Tax Credit: This

credit can get you between $519 and $6,431 in tax year 2018 depending

on how many kids you have, your marital status and how much you make.

It’s something to explore if your AGI is less than about $55,000.

• Charitable donations deduction: If

you itemize, you may be able to subtract the value of your charitable

gifts — whether they’re in cash or property, such as clothes or a car —

from your taxable income.

• Medical expenses deduction: In

general, you can deduct qualified, unreimbursed medical expenses that

are more than 7.5 percent of your adjusted gross income for the tax

year.

• Deduction for state and local taxes: You

may deduct up to $10,000 ($5,000 if married filing separately) for a

combination of property taxes and either state and local income taxes or

sales taxes.

• Mortgage interest deduction: The

mortgage interest tax deduction is touted as a way to make

homeownership more affordable. It cuts the federal income tax that

qualifying homeowners pay by reducing their taxable income by the amount

of mortgage interest they pay.

• Gambling loss deduction: Gambling

losses and expenses are deductible only to the extent of gambling

winnings. So, spending $100 on lottery tickets isn’t deductible — unless

you win, and report, at least $100, too. You can’t deduct more than the

amount you win.

• IRA contributions deduction: You

may be able to deduct contributions to a traditional IRA, though how

much you can deduct depends on whether you or your spouse is covered by a

retirement plan at work and how much you make.

• 401(k) contributions deduction: The

IRS doesn’t tax what you divert directly from your paycheck into a

401(k). For 2018, you can funnel up to $18,500 per year into such an

account. If you’re 50 or older, you can contribute up to $24,500. These

retirement accounts are usually sponsored by employers, although

self-employed people can open their own 401(k)s.

• Saver’s Credit: This

runs 10 to 50 percent of up to $2,000 in contributions to an IRA,

401(k), 403(b) or certain other retirement plans ($4,000 if filing

jointly). The percentage depends on your filing status and income.

• Health Savings Account contributions deduction: Contributions

to HSAs are tax-deductible and the withdrawals are tax-free, as long as

you use them for qualified medical expenses. For 2018, if you have

self-only high-deductible health coverage, you can contribute up to

$3,450. If you have family high-deductible coverage, you can contribute

up to $6,900.

• Self-employment expenses deduction: There are many valuable tax deductions for freelancers, contractors and other self-employed people.

• Home office deduction: If

you use part of your home regularly and exclusively for

business-related activity, the IRS lets you write off associated rent,

utilities, real estate taxes, repairs, maintenance and other related

expenses.

• Educator expenses deduction: If you’re a teacher or other eligible educator, you can deduct up to $250 spent on classroom supplies.

• Residential energy credit: This

one can get you up to 30 percent of the installation cost of solar

energy systems, including solar water heaters and solar panels, in 2018.

— Tina Orem, NerdWallet.com